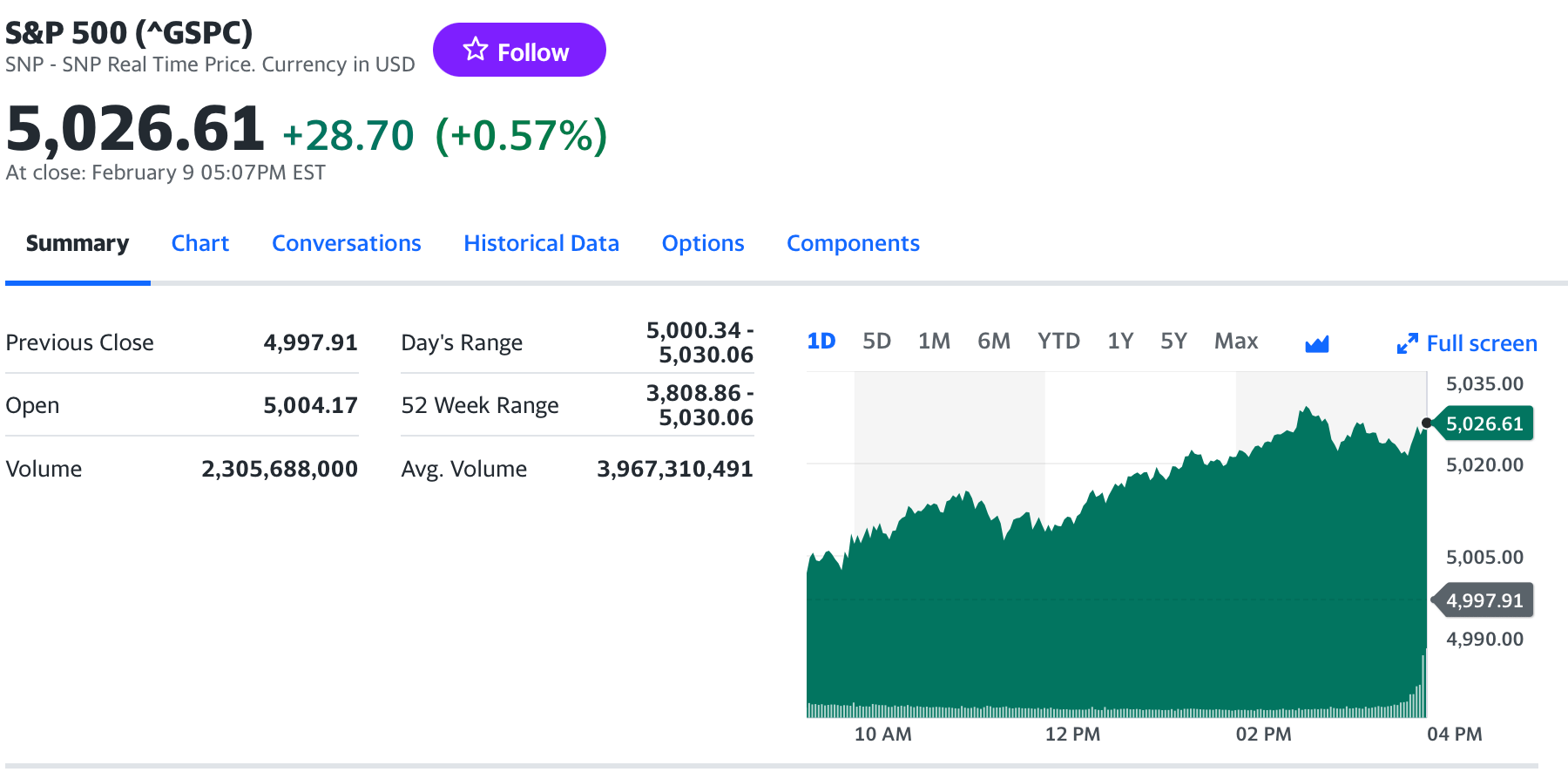

In what was a shocking revelation yesterday, the S&P 500 managed to close at 5,027, a nice 0.57% jump over the previous day’s starting price. The S&P consists of 500 of the largest companies on the NASDAQ block, meaning that it gives a strong indication of how many investors are feeling not only about certain companies, but over the economy as a whole.

The eclipse of 5,000 means that investors are confident in the inflation rates and consistent progression the economy has shown since the relapse of COVID. However, people are still concerned about the lack of equal viewings the S&P 500 currently shows.

Tech companies are giving a huge boost to these numbers simply due to their size and magnitude on the current economic status of America. The New York Times reported that Apple, Microsoft, Meta, Amazon, and Alphabet (Google) have climbed tremendously over the past week or so. All of these companies, along with some other non-tech (Disney, Ford, Chipotle) have turned around significantly better earnings than expected, leading to the buzz of a rising stock market.

It’ll be quite interesting to see how this momentum can carry on, as well as when the Feds will decide to cut the federal rate in light of this extraordinary achievement.

Sources:

https://finance.yahoo.com/quote/^GSPC?p=^GSPC&.tsrc=fin-srch

Image Credits: Yahoo Finance