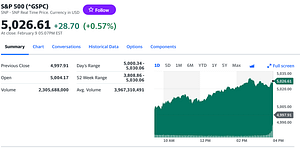

Wall Street has seen its inconsistencies shine in the bright lights during a tumultuous month of stock marketing. In late April, the NASDAQ reached a new career-high in closing, ending the day at $14,138.78. The wheels have since fallen off, and over the last thirty days, prices have dropped nearly 5%. Meanwhile, the Dow Jones Industrial Average (DJIA) has seemingly been positive for eternity now, with stable showings all around. The closing for today was $34,207.84, nearly 0.7% higher than the closing last month. Although the Dow Jones has seen its lows, the trend is most certainly bullish.

In terms of private companies, Tesla (TSLA) was once beating the brakes off everyone in the market, becoming an absolute nightmare for short-sellers. Now, it’s becoming a target. The electric car company monitored by the eccentric Elon Musk has been bearish for the past five weeks, a sight rarely seen for such a successful company. During the last month alone, Tesla’s share price has dropped 21.3%, a negative for long-term investors hoping to make a profit. Musk needs to make a stronger case for his company rather than vouch for popular cryptocurrencies Dogecoin and Bitcoin. If he does not bring it together, Tesla will become yesterday’s choice for long-term investing.

Sticking with technology, the gaming company Roblox (RBLX) absolutely dominated the market on Friday, jumping over 8% at closing share prices. The company has been publicly available for trading since March of 2021, and it has not disappointed. Its shares have been up 10% since last month, and the outlook for many investors is positive. If Roblox can continue running on fumes similar to this week, the company will make killer money for those willing to buy shares. The question is… can the hot streak last, or will the flames soon be extinguished?

Around the health market, Pfizer (PFE) and BioNTech saw strong earnings this past month, with both companies’ share prices rocketing 3.3 and 12 percent respectively. Tech giants Google (GOOGL) slightly dipped, while shopping supreme Amazon (AMZN) sunk dramatically, with a loss of 6% share prices in May. Social media application Twitter (TWTR) plummeted over 18% in less than thirty days, while rival Facebook (FB) climbed 4.35%.

https://www.google.com/finance/

Image Credits: Getty